Treading through the mortgage sector’s competitive tides is akin to navigating a stormy ocean. Amid the swirling currents of competition, a masterfully crafted Mortgage Broker SEO strategy stands as your beacon toward triumph. Far beyond a mere trend, SEO is the lifeblood pulsating through the veins of your digital visibility and business expansion. In this guide, we’ll dive deep and demystify the intricacies of SEO tailored for mortgage brokers. Our endgame? Ensure your enterprise soars to the zenith of search results when potential clients scout for mortgage services.

The Transformative Power of Mortgage SEO for Your Mortgage Business

The digital universe is a wild, uncharted expanse for numerous mortgage brokers, brimming with untapped potential. SEO is critical to claiming your territory, ensuring your offerings outshine amidst a galaxy of alternatives. Here’s the magic it brings to your mortgage venture:

- Visibility Amplified: SEO catapults your website’s ranking in Google’s search results, propelling your services closer to those seeking them.

- Trust and Credibility: Securing a top-tier ranking in search results signals to potential clients that you’re a heavyweight in the mortgage arena.

- Engagement Boost: By syncing your content with client needs, SEO lures quality traffic to your site, prompting visitors to delve into your mortgage solutions.

- Timeline of Outcomes: Unlike the instant fixes of digital ads, SEO is a marathon, not a sprint. While initial results may take months to surface, their impact multiplies as time passes.

- ROI Prospects: Channeling resources into SEO for your mortgage site translates into superior organic search rankings, a surge in leads, and, ultimately, a beefed-up ROI.

- Tracking Triumphs: Tools like Google Analytics empower you to monitor vital metrics, from web traffic to conversion ratios, ensuring your SEO endeavors are quantifiable and perpetually honed.

Deciphering the Mortgage Broker SEO Terrain

In the world of mortgage broker SEO, understanding the terrain is crucial. The SEO landscape is dynamic, shaped by algorithms, keywords, and the ever-changing behaviors of online users. Let’s decode this landscape to build a solid foundation for your mortgage business’s online strategy.

The Mechanics of Search Engines

- Inner Workings of Search Engine Results: At the nucleus of search engines like Google is a sophisticated algorithm that retrieves the most pertinent and authoritative content in response to a user’s inquiry. Elements like keyword pertinence, site swiftness, and mobile optimization are critical to your site’s ranking.

- Navigating Google’s Algorithmic Shifts: Staying afloat in SEO demands agility. Google routinely refines its algorithms; every tweak is a fresh chance to polish and elevate your mortgage broker’s SEO approach.

The Dual Forces in Search Engine Optimization

SEO, a two-sided coin, entails On-Page and Off-Page SEO. Each side is crucial, intertwining to amplify your site’s prominence and ranking in the vast digital universe.

- On-page SEO is about sprucing up individual web pages to increase search rankings. It’s a meticulous mix of content refinement and HTML source code tweaking, focusing on components like title tags, headings, and internal links.

- Off-Page SEO: Contrasting On-Page SEO, this aspect revolves around external elements shaping your site’s stature and authority. It’s about curating quality backlinks and harnessing social media’s power to fortify your online presence.

Get Your FREE eBook +

Traffic Projection Analysis

+ Website Quality Audit!

On-Page SEO for Your Mortgage Website

Perfecting On-Page SEO ensures your website welcomes and captivates visitors. For mortgage brokers, it’s about concocting a site that’s informative and structured to win search engines’ hearts.

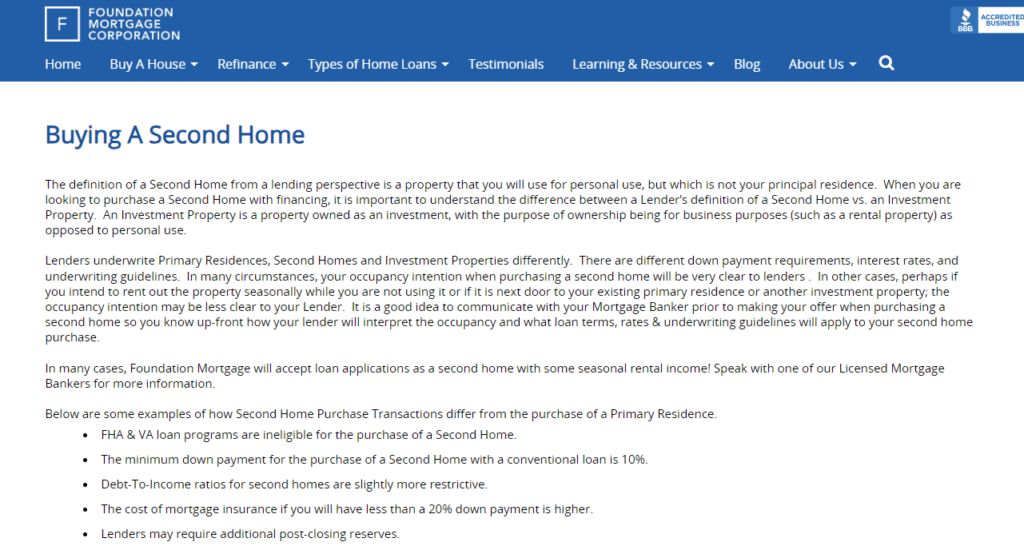

Flesh Out Your Pages for Your Content Marketing

- Purpose-Driven Pages: Every nook of your mortgage site should have a distinct intent, be it enlightening about rates or navigating the application maze. Your content must be rich and resonate with your audience’s quests.

- Rich Media: Embed images, videos, and infographics to simplify intricate mortgage concepts. Remember, each visual should carry descriptive alt text for SEO and user accessibility.

Tailor Each Page for Search Engines

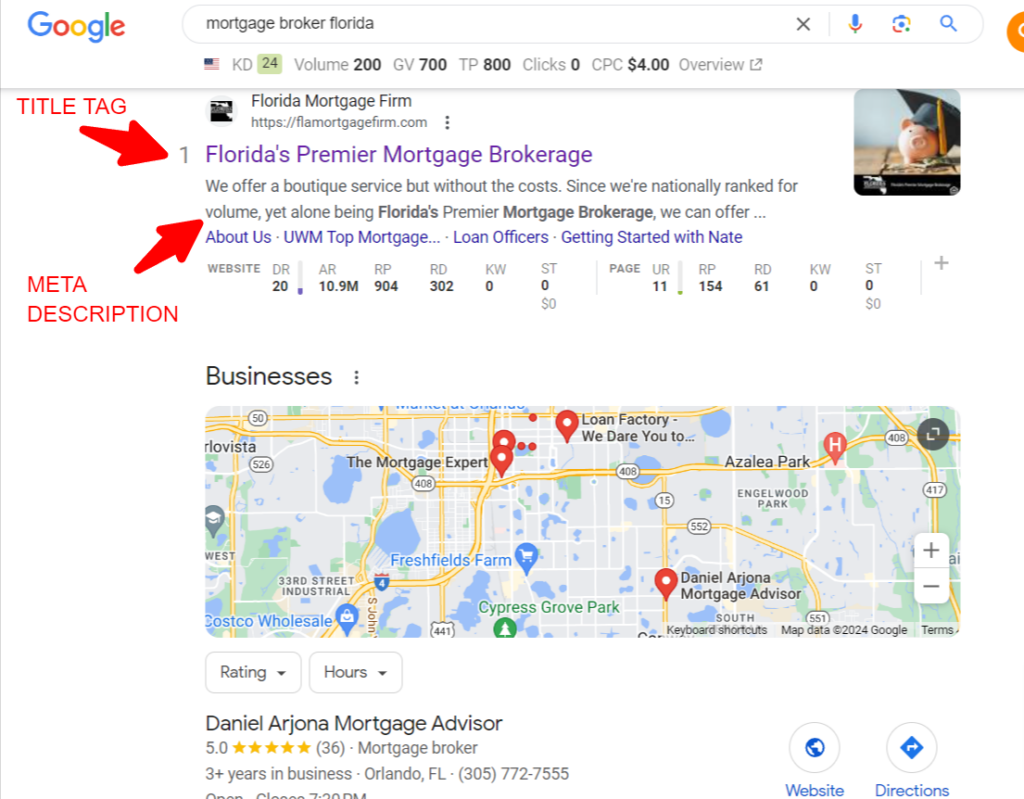

- Title Tags: Picture these as your web pages’ billboards in search engines’ view. Craft each title to be unique, keyword-rich, and enticing enough to prompt a click.

- Meta Descriptions: This is not a ranking lever, yet these snippets offer a glimpse of your page’s essence. A snappy meta description can boost click-through rates from search results.

- Header Tags (H1, H2, H3): Use these to structure your content. They ease reading for humans and help search engines grasp your content’s structure and significance.

- Keyword Optimization: Weave in your primary and related keywords seamlessly. Sidestep overstuffing; aim for a natural flow that upholds your content’s caliber.

- Internal Linking: Forge links to other relevant site pages, engaging users and steering them through their mortgage expedition. Linking also aids search engines in efficiently scanning your site, ensuring your mortgage broker business listing gets noted.

Off-Page SEO Strategies for Mortgage Brokers

While On-Page SEO fine-tunes your digital space’s interior, Off-Page SEO broadens your clout across the digital neighborhood. It’s about sculpting a stellar reputation and cementing your authority in the mortgage realm, extending beyond your site.

Backlink Building

Top-notch, authoritative backlinks act as endorsements in SEO. They hint to search engines that esteemed websites acknowledge your content.

- Guest Blogging: Offer top-tier content to reputable mortgage sites. Guest Posting garners backlinks and cements your status as an industry sage.

- Local Partnerships: Forge ties with regional entities. Partnerships can spawn valuable local backlinks, which is pivotal for Local SEO.

- Reputable Directories: Register your business in credible directories, ensuring consistent, precise listings, particularly in niche directories.

Harnessing Social Media

Though social media links are generally “nofollow” and don’t directly bolster your SEO, they amplify your brand’s visibility and funnel traffic to your site. Interact with your audience via insightful content, mortgage advice, and sector updates. A robust social media presence can subtly sway your SEO by inflating brand searches and site visits.

Online Reviews and Reputation Crafting

- Urge content clients to post glowing reviews on platforms like Google My Business and sector-specific review sites.

- Tackle negative reviews with professionalism and swiftness. Staying on top of your reviews softens the sting and showcases your commitment to client contentment.

Advanced Mortgage Keyword Integration Strategies

Diving into the vast sea of keywords might seem intimidating. Still, with savvy strategies, you’re set to navigate toward SEO stardom. The trick? Grasp the vocabulary of your audience and fine-tune your content to respond to their inquiries spot-on.

Mastering Keyword Optimization

- Grasping User Intent: Catch the drift behind those search queries. Are users scouting for mortgage insights, or are they set to apply? For instance:

- Informational Intent: “What are the current mortgage rates?”

- Navigational Intent: “Mortgage broker near me”

- Transactional Intent: “Apply for a fixed-rate mortgage”

Craft your content to match these intents. A blog post might hit the spot for info seekers, while a crisp product page could appeal to those ready to act.

Long-Tail Keywords:

Unleash the magic of specificity. Long-tail keywords, though less searched, attract a more pinpointed crowd. Something like “flexible-rate mortgage for freelancers in Miami” zeroes in on a specific bunch, boosting engagement and conversion prospects.

Semantic Search Optimization:

Search engines are getting smarter, interpreting the context and web of words. Sprinkle related terms and synonyms to create content that’s rich and context-aware. For instance, alongside “mortgage rates,” weave in phrases like “interest rates,” “loan conditions,” or “financial strategy.”

Deep Dives with SEO Tools:

- Unearth the depths with tools like Google Keyword Planner or SEMrush. Peek beyond mere numbers; delve into trends, seasonality, and local flavors of keywords.

- Google Trends: Navigate the seasonal highs for phrases like “top mortgage rates” or “home financing.” This information can steer your content calendar towards timely, spot-on articles.

Competitor Analysis:

Do a deep dive into what the rivals are up to. Tools like Moz and Ahrefs shed light on their top pages, the keywords they’re winning with, and the sources of their backlinks. Spot the gaps. What queries are your rivals leaving unanswered? Can you craft detailed guides or FAQ sections to fill these voids?

Keyword Clustering:

Step beyond optimizing for single keywords. Cluster-related terms to build topic authority. For instance, a cluster around “mortgage applications” might include “mortgage application steps,” “needed documents for mortgage,” and “common mortgage application mistakes.”

Crafting SEO Content That Resonates and Ranks

Understanding Your Audience:

- First-Time Homeowners: Offer guides on the basics of mortgages, explain terms in simple language, and provide checklists for buying their first home.

- Seasoned Investors: Publish market insights, tactics, and intricate financing options. Tailor your content to their savvy level and investment ambitions.

- Refinancing Individuals: Present calculators for rate comparisons, articles on optimal refinancing times, and success tales highlighting timely refinancing benefits.

Crafting a Content Calendar

Theme-Based Planning:

- Align your content with relevant themes, whether seasonal or in tune with financial cycles. Content like “How to get the Best Mortgage Rates” could align with rate announcements from central banks.

- Capitalize on particular months or observances like Financial Literacy Month to churn out educational content pieces.

Content Series:

- Develop a series that keeps your audience hooked and coming back for more. Maybe something like “Mortgage Mondays” offers weekly tips, news, or market buzz. It’s about creating consistent touchpoints with your audience.

Creating a Structured Approach:

- Design your content plan to balance SEO with a smooth read. Kick off with a gripping intro, weave through a well-ordered body with H2s and H3s for subtopics and wrap up with a compelling call to action.

- Blend in keywords like a pro. Ensure they mesh naturally into your sentences, keeping the read engaging and flowing.

Optimize for Skimmers and SEO:

- Break It Down: Utilize headings, subheadings, bullet points, and short paragraphs. These elements are lifesavers for online readers who tend to skim. They catch the essence of your content swiftly.

- SEO and Flow: Balance SEO optimization with readability. Keywords should flow naturally within your content, similar to how people search mortgage lender listings, avoiding any hint of stuffing.

Variety in Your Content:

- Infographics: Draft visuals simplifying complex mortgage procedures or stats. An infographic detailing mortgage acquisition steps can inform and engage.

- Videos: Roll out explainers or customer stories. A step-by-step guide on mortgage application do’s and don’ts can be a natural aid for potential clients.

- Podcasts: A less-touched channel by many mortgage brokers for their marketing efforts. Start a series on market trends or interviews with industry pros. Ideal for those who prefer their content audible and on-the-go.

Elevate Your Content Quality and Engagement

- Dive Deep Occasionally: Sometimes, it’s wise to craft in-depth articles that explore topics thoroughly. Imagine an ultimate guide that unravels the mysteries of different mortgage rates. Such a resource can be priceless.

- Calculators and Questionnaires: Incorporate tools like mortgage calculators or personalized quizzes. Imagine a calculator that illustrates potential savings from refinancing. Engaging and practical!

- Quizzes for Fun and Insight: Design quizzes like “Discover Your Ideal Mortgage Type” to add a fun, interactive element to the learning journey.

- Ramp up engagement with visuals like charts, graphs, or infographics. For instance, a visual face-off between fixed-rate and adjustable-rate mortgages can offer quick, valuable insights.

Case Studies and Success Stories:

- Client Spotlights: Feature diverse tales where your services made a real difference.

- Before and After Snapshots: Show off the impact of your advice on clients’ mortgage terms and costs. Real-life figures and stories lend your content authenticity and allure.

- Testimonials: Weave honest client feedback throughout your content. Genuine reviews can significantly jack up trust and credibility.

Keep Your Content Fresh:

- Stay current with mortgage industry news and updates to improve your Google search results. Regularly revisit and refresh your posts to mirror the latest mortgage rates, regulations, and market vibes. Content refreshes serve your readers well and signal search engines that your content is fresh off the press.

Local SEO for Mortgage Brokers: Community Connection

Local SEO ensures that you’re the go-to spot when folks in your area seek mortgage services. It’s about tailoring your digital footprint to be geographically pertinent and reachable.

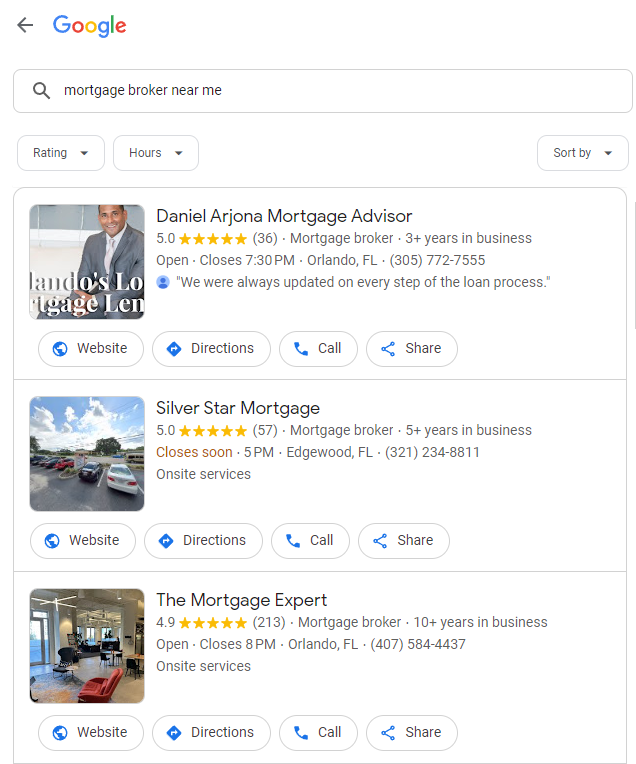

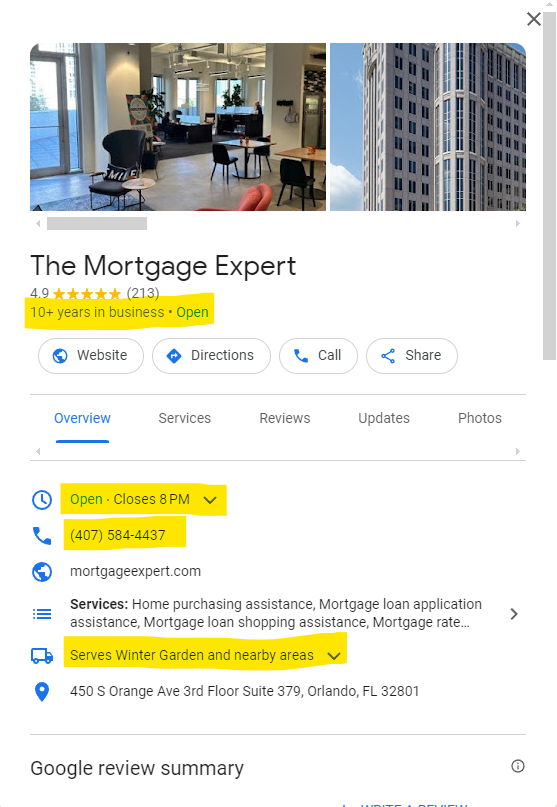

Optimize for Google Business Profile (Formerly Google My Business):

- Claim and Verify: Secure your GBP listing. Make sure every detail is spot-on and up-to-date.

- Consistency in NAP: Your Name, Address, and Phone number must be uniform across GMB and all online directories.

- Detailed Services and Categories: List all services you offer and categorize your business accurately.

- Engage Through Reviews: Encourage happy clients to leave positive reviews. Address all reviews professionally, showcasing your dedication to client satisfaction.

Local Keywords and Content:

- Geo-Targeted Keywords: Weave location-specific keywords into your website’s content, meta tags, and titles. Phrases like “mortgage broker in [Your City]” are golden.

- Content with Local Flavor: Produce content that resonates with your local audience. Focus on community involvement, local market insights, or area-specific advice.

Local Link Building:

- Community Engagement: Connect with local businesses and partake in community events. Many successful mortgage companies have incorporated community engagement into their marketing strategies. These activities can earn you valuable local backlinks.

- Local Directories: Ensure your business features in local directories and citation sites. Consistency is key here.

Optimizing for ‘Near Me’ Searches:

- ‘Near Me’ SEO: Optimize your site for these searches by clearly stating your location. Include a Google Maps pin on your contact page for extra points.

- Mobile-Friendly: Most ‘near me’ searches happen on mobile devices. So, ensuring your site is mobile-friendly is non-negotiable.

Social Media and Local Engagement:

- Engage Locally on Social Media: Share local news, engage in community chats, or showcase local customer stories.

- Local Hashtags: Use these on platforms like Instagram or Twitter to boost your visibility in local searches.

Structured Data Markup:

- Local Business Schema: Implement this on your website to help search engines display your business info in local searches. It’s a visibility booster.

Technical SEO: The Support Structure

Technical SEO might be behind the scenes, but it’s the scaffold supporting your entire SEO framework. It ensures your site is findable, navigable, and understandable to users and search engine bots.

- Site Speed: In our fast-paced digital era, speed matters. A sluggish site can deter visitors and dent your ranking. Use tools like Google’s PageSpeed Insights to keep your site zippy.

- Mobile Responsiveness: A mobile-friendly site is non-negotiable. Google’s mobile-first indexing means your mobile site’s performance is crucial.

- Security and Accessibility: HTTPS is a must for security and trust. A well-laid-out XML sitemap and robots.txt file guide search engines through your site, ensuring smooth crawling.

- Structured Data: Schema markup clarifies the context of your content to search engines. For mortgage brokers, marking up rates, services, and reviews can spotlight your offerings in search results, perhaps even earning rich snippets.

- Regular Site Audits: Routine checks are essential to spot and fix SEO glitches. Watch out for broken links and duplicate content, and stay abreast of SEO best practices.

Navigating and Refining SEO Tactics

In the SEO world, the terrain is ever-changing. Strategies that hit the mark today might miss tomorrow. Hence, consistently measuring your SEO prowess and staying nimble to adapt is essential for keeping your edge in the bustling mortgage market.

Monitoring and Refining Your SEO Efforts

- Harnessing Analytics Tools: Google Analytics and Google Search Console are vital for monitoring your site’s pulse. They offer insights into traffic, user habits, conversion metrics, and your pages’ search engine standings.

- Defining KPIs: Set precise KPIs to gauge the effectiveness of your SEO strategy. Consider tracking organic traffic, rankings for chosen keywords, click-through rates (CTRs), and lead or application conversion rates.

- Routine Reports and Analysis: Regularly dissect your analytics. Spot trends, like pages with soaring bounce rates or underperforming keywords, and tweak your strategy as needed.

Staying On Top of SEO’s Fluid Nature

- Algorithm Alertness: Search engines like Google often tweak their algorithms. Keep tabs on these changes and grasp how they could sway your site’s performance.

- Ongoing Learning and Refinement: SEO is an ongoing endeavor, not a one-off task. It demands constant learning, experimentation, and fine-tuning. Dive into webinars, track industry blogs, and join SEO forums to stay informed about the freshest trends and tactics.

- Adaptability and Proactiveness: The digital scene is constantly in flux. Be ready to shift your strategies in response to new trends, market movements, or shifts in consumer behavior. Staying proactive ensures your mortgage site remains a step ahead.

Wrapping Up

Embarking on your mortgage brokerage’s SEO voyage is more than boosting your online presence. It’s about carving your niche, cultivating trust with your audience, and guiding them through one of life’s pivotal decisions. By mastering SEO’s nuances, you pave your path to success and illuminate the route for your clients in their quest for their ideal homes.

Are you keen on propelling your mortgage brokerage to digital pinnacles? Reach out for tailor-made Mortgage Broker SEO services. Let’s navigate together to the summit of search rankings!

FAQ

How do I market myself as a mortgage broker?

A multi-faceted approach is essential to market yourself as a mortgage broker effectively. Establish a solid online presence through social media platforms like LinkedIn, Facebook, and Instagram, where you can connect with potential clients and other industry professionals. Networking is crucial, so attend local real estate events and join business groups. This not only builds relationships but also enhances your visibility. Implementing content marketing is another powerful tool. By writing informative blog posts, creating videos, and sharing industry insights, you establish yourself as a knowledgeable and reliable source in the mortgage sector. Additionally, set up a referral program that incentivizes satisfied clients to refer others, expanding your client base organically. A well-designed, SEO-optimized website is also vital, providing clear information about your services, client testimonials, and easy contact options.

How much do mortgage brokers spend on marketing?

The amount mortgage brokers spend on marketing can vary significantly. Typically, brokers allocate between 2-10% of their revenue towards marketing efforts. This percentage can be higher for newer brokers working to establish a market presence, while more established brokers might spend a smaller proportion as their reputation and client base have already developed.

What are the marketing materials for mortgage brokers?

Essential marketing materials for mortgage brokers include business cards, which are fundamental for networking and meetings. Brochures and flyers provide detailed information about services and mortgage options, helping to educate potential clients. Email newsletters offer regular updates about market trends and services, keeping clients engaged. Additionally, creating social media graphics and informative guides like eBooks or PDFs on home buying or mortgages can significantly aid in attracting and educating potential clients.

How do you get clients as a mortgage broker?

Acquiring clients as a mortgage broker requires a strategic approach. Building a strong referral network with past clients and real estate agents is a great start. Digital marketing, social media, and Google ads can reach a broader audience. Optimizing for local SEO helps in appearing in local search results, which is crucial for attracting clients in your area. Engaging with your community through regional events and sponsorships can also raise your profile. Furthermore, collaborations with realtors, financial planners, and attorneys can provide steady referrals.

How do I market myself as a mortgage advisor?

Marketing yourself as a mortgage advisor involves a mix of personal branding and outreach. Hosting educational workshops or webinars can establish you as an authority in the field. A unique value proposition and a compelling brand story are essential to stand out. Sharing client testimonials and success stories on your website and social media platforms builds trust and credibility. Implement targeted advertising to focus on specific demographics or regions. Professional partnerships with financial advisors and estate agents can also be a fruitful marketing strategy.

How do I become a successful mortgage broker?

Success as a mortgage broker hinges on continuous learning and exceptional customer service. Keeping abreast of the latest mortgage products, regulations, and market trends is crucial for providing the best service to your clients. Prioritizing client satisfaction and maintaining strong communication helps in building lasting relationships. Employing efficient technological systems to streamline processes enhances the client experience. Regularly assessing and adapting your marketing strategies in response to industry changes is also crucial. Building a solid personal brand and maintaining an active online presence can significantly contribute to your success in this competitive field.